Table of Contents

- Maximize Your Income by Understanding New 2024 Tax Brackets | Rise2Be

- What’s My 2024 Tax Bracket? | Hays Breard Financial Group

- 2024 To 2025 Tax Brackets - Elke Nicoli

- New Bracket Thresholds, Rising Contribution Limits, and Other Tax ...

- Budget 2024 tax calculator: See how tax cuts affect you and what’s in ...

- How Project 2025 could impact your tax bracket and capital gains under ...

- Your 2024 Tax Brackets Are Here! — Lee Stoerzinger Wealth Management

- New Tax Brackets 2024 by IRS - Markets Today US

- How Tax Brackets Work: 2024 Guide | Money Instructor - YouTube

- Gaea Verneris on LinkedIn: The IRS just announced new 2024 Tax Brackets ...

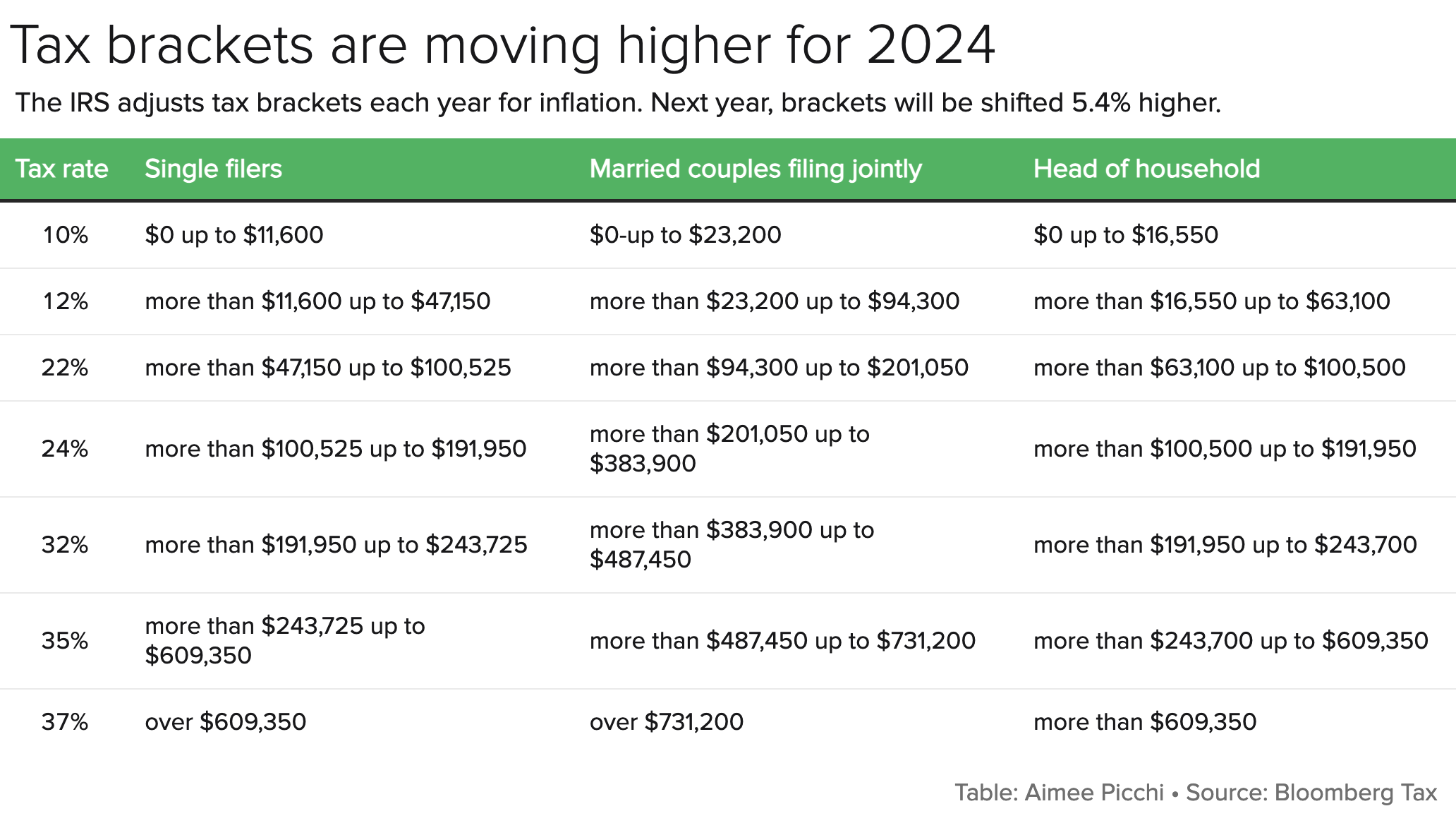

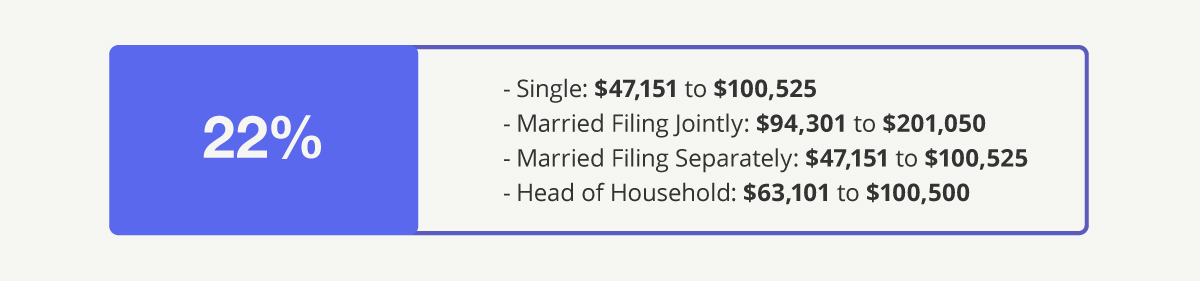

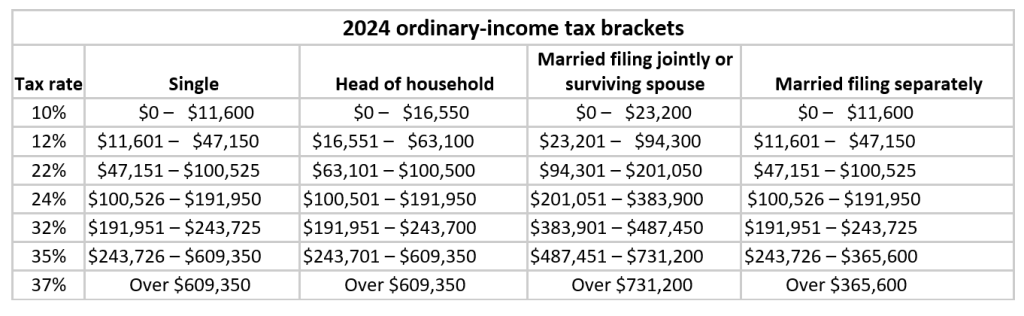

2024 Federal Tax Brackets and Rates

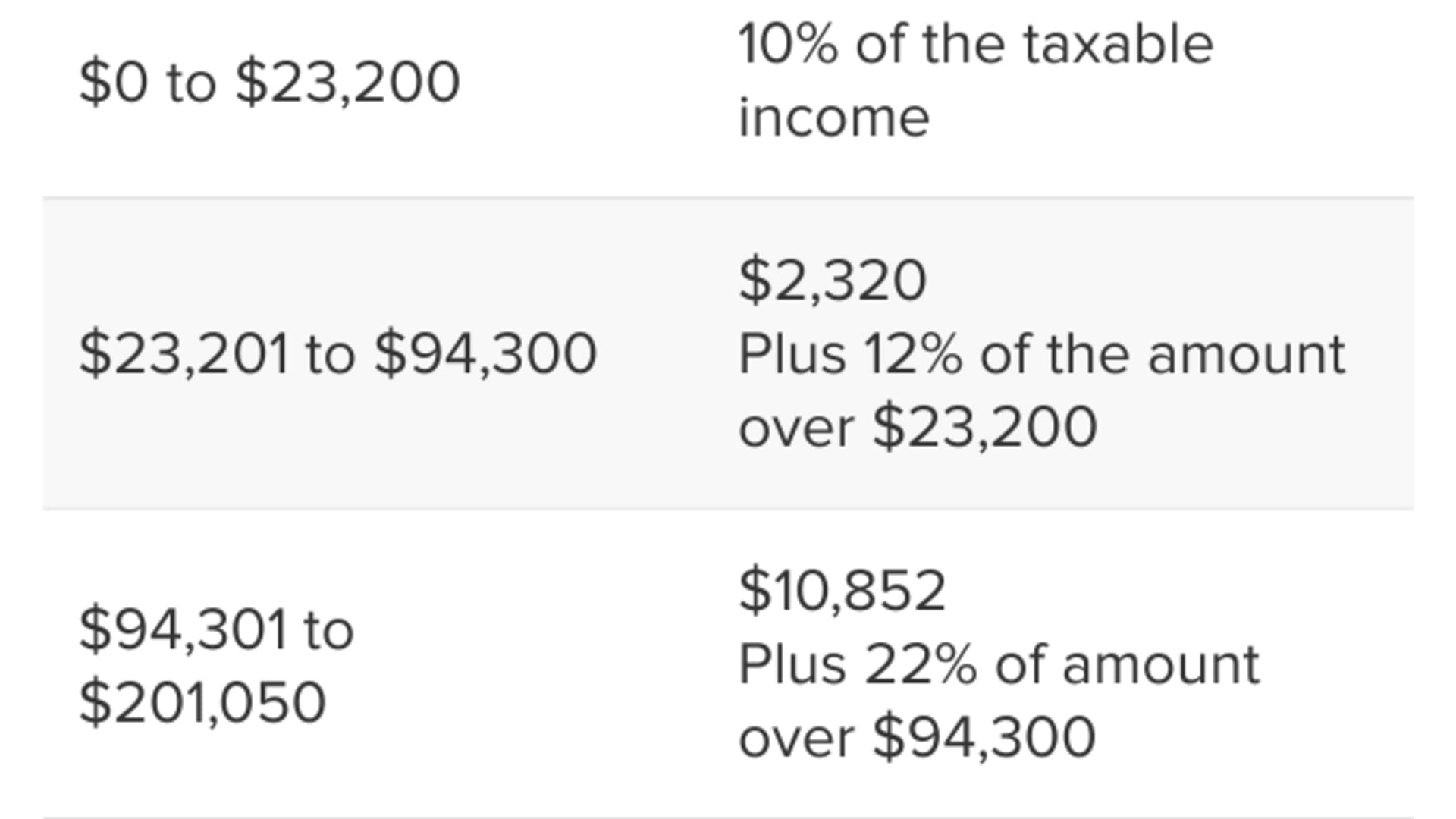

How the 2024 Tax Brackets Work

Key Takeaways for Taxpayers

Understanding the 2024 tax brackets is crucial for taxpayers to make informed decisions about their finances. Here are some key takeaways: Taxpayers should review their tax withholding to ensure they are not overpaying or underpaying their taxes. The 2024 tax brackets may impact tax planning strategies, such as income deferral or acceleration. Taxpayers should consider consulting a tax professional to ensure they are taking advantage of all available tax deductions and credits. The 2024 tax brackets and rates provide a framework for taxpayers to understand their federal tax obligations. By staying informed about the latest tax changes, taxpayers can make informed decisions about their finances and minimize their tax liability. Whether you're a individual taxpayer or a business owner, it's essential to stay up-to-date on the latest tax developments to ensure you're in compliance with federal tax laws. Visit the Tax Foundation website for more information on the 2024-2025 federal tax brackets and rates.This article is for informational purposes only and should not be considered tax advice. Consult a tax professional for personalized guidance on your specific tax situation.